How to Calculate GST – Step-by-Step Guide

Goods and Services Tax, or GST as most folks call it, was a game-changer for India’s tax system when it rolled out in July 2017. It basically swept away a bunch of old indirect taxes like VAT, service tax, excise duty, and luxury tax, pulling everything under one simple roof. Whether you’re just starting out as a small shop owner, running a startup, or managing a big company, figuring out how to calculate GST is key for getting your pricing right, sending out accurate bills, and staying on the right side of the law.

In this straightforward guide, I’ll walk you through the different ways to calculate GST, break down the formulas for inclusive and exclusive prices, and toss in some real-life examples. By the time you’re done reading, you’ll feel confident about how GST impacts what you pay or charge, and why getting it spot-on is a big deal for everyone involved.

Understanding the Basics of GST

Before we dive into the nitty-gritty of calculations, let’s get a quick grip on what GST really is. GST stands for Goods and Services Tax, and it’s a tax that’s based on where the goods or services end up, not where they’re made. It gets slapped on pretty much every supply of goods and services. The old system had taxes piling up at every step of the chain, but GST keeps things uniform and clear-cut.

The idea behind GST was to make taxes easier to handle, ditch that annoying “tax on tax” cascade, and create a smoother ride for businesses and shoppers alike. Goods and services get sorted into tax brackets like 0%, 5%, 12%, 18%, and 28%, depending on what they are. So, the rate you use depends on whatever you’re buying or selling.

GST Exclusive vs. GST Inclusive Prices

When it comes to crunching GST numbers, you’ve got to know the difference between two kinds of prices:

- Exclusive of GST (Base Price): This is the price tag before you tack on the tax. If you’re selling something, you start here and add GST to get what the customer actually pays.

- Inclusive of GST (Final Price): This one’s the total amount, tax and all. It’s what you often see on your receipt, with the base cost and GST already mixed in.

Getting this straight matters because the math flips a bit depending on which one you’re starting with.

How to Calculate GST on an Exclusive Price

If you’ve got the base price and need to add GST, it’s pretty simple. Here’s the formula:

GST Amount = (Original Cost × GST Rate) ÷ 100

Final Price = Original Cost + GST Amount

Let’s say a gadget costs ₹1,000, and it’s hit with 18% GST.

GST Amount = (1,000 × 18) ÷ 100 = ₹180

Final Price = 1,000 + 180 = ₹1,180

This is the go-to method for businesses when they’re whipping up invoices.

How to Calculate GST on an Inclusive Price

Now, flip it around: You’ve got the total price with GST baked in, and you want to split out the base and the tax. The formula changes to:

Base Price = (Inclusive Price × 100) ÷ (100 + GST Rate)

GST Amount = Inclusive Price – Base Price

For instance, if something rings up at ₹1,180 inclusive of 18% GST:

Base Price = (1,180 × 100) ÷ 118 = ₹1,000

GST Amount = 1,180 – 1,000 = ₹180

People call this reverse GST or inclusive calculation. It’s handy if you’re a shopper double-checking your bill.

GST Calculation for Multiple Slabs

GST can get a tad tricky because not everything’s taxed the same. Here’s a rundown of the slabs in India right now:

- 0% for must-haves like fresh fruits, veggies, milk, and things like education services

- 5% for everyday basics and some foods

- 12% for stuff like processed foods, computers, and certain business services

- 18% for a ton of common items, from electronics to household goods

- 28% for luxuries like fancy cars, tobacco, or high-end gadgets

First things first: Figure out which slab your item falls into. Then, plug in the rate using the exclusive or inclusive formulas we just covered.

How to Calculate GST for Businesses

For folks running a business, GST isn’t just about adding a percentage to a price—there’s more to it. You’ve got to:

- Look up the HSN code for goods or SAC code for services to nail down the right GST rate.

- Slap the correct GST on your invoices.

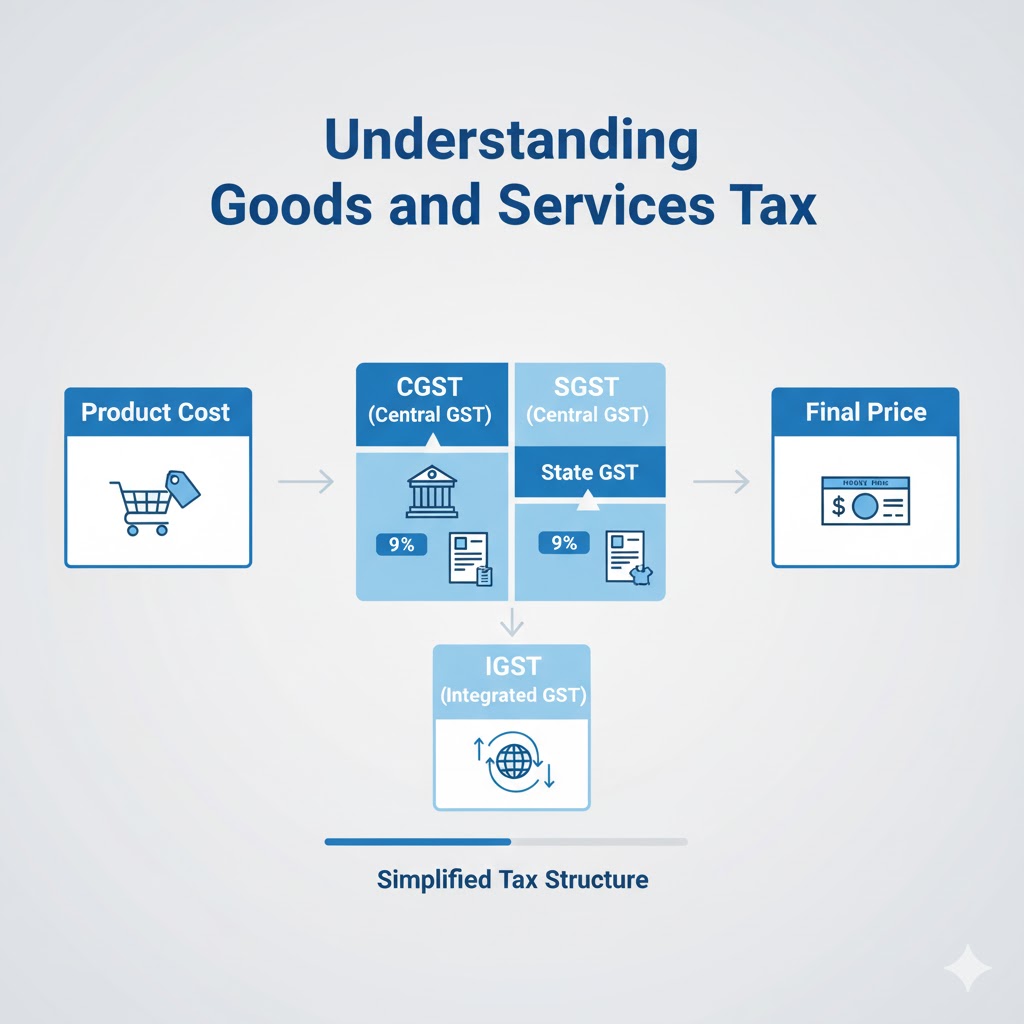

- Break it into CGST (Central GST) and SGST (State GST) if it’s a sale within your state, or go with IGST (Integrated GST) for out-of-state deals.

- File those GST returns on time to keep things legit.

Take this example: A Delhi-based business sells ₹50,000 worth of goods right there in Delhi at 18% GST.

CGST = 9% of 50,000 = ₹4,500

SGST = 9% of 50,000 = ₹4,500

Total GST = ₹9,000

Final Price = ₹59,000

But if they’re shipping to Mumbai? It’s IGST at 18%:

IGST = ₹9,000

Final Price = ₹59,000

Online GST Calculators

Doing GST math by hand every single time? Yeah, that can be a drag. That’s where online GST calculators come in clutch. Just punch in your base or total price and the rate, and boom—they spit out the GST amount and final figure.

They cut down on mistakes and speed things up, especially when you’re cranking out bills.

Importance of Accurate GST Calculation

Getting GST right isn’t optional—here’s why it matters:

- For Businesses: It keeps everything transparent, avoids arguments with customers, and helps you stay compliant. Mess it up, and you could face fines or bounced returns.

- For Customers: You won’t get ripped off, and you can easily spot-check the tax on your receipt.

- For the Government: It makes sure the revenue gets split fairly between the center and states.

GST Interest and Late Fees

On top of regular GST on sales, businesses have to watch out for interest and fees if things slip.

GST Interest Calculation

Miss a payment deadline? You’ll owe interest at 18% per year on what’s due. The formula:

Interest = Tax Amount × (Interest Rate ÷ 100) × (Number of Days ÷ 365)

Say you’ve got ₹10,000 in GST that’s 30 days late:

10,000 × (18 ÷ 100) × (30 ÷ 365) ≈ ₹148.

GST Late Fee Calculation

Delay your return filing, and late fees kick in—usually ₹50 a day (₹25 each for CGST and SGST). For zero-tax returns, it’s ₹20 a day.

Example: 10 days late on GSTR-3B? That’s 10 × ₹50 = ₹500.

Common Mistakes in GST Calculation

The formulas are basic, but slip-ups happen. Watch out for:

- Picking the wrong slab.

- Mixing up inclusive and exclusive methods.

- Skipping the CGST/SGST split for in-state sales.

- Not adjusting when rates shift.

- Forgetting about those interest and late fees in returns.

Steer clear of these, and you’ll dodge headaches and penalties.

Practical Scenarios of GST Calculation

Let’s make this real with a few everyday examples:

- Restaurant Bill: You grab food for ₹2,000, and GST is 5%. That’s ₹100 in tax, so your total’s ₹2,100.

- Buying Electronics: A ₹50,000 laptop at 18% GST means ₹9,000 tax, and you walk out paying ₹59,000.

- Online Shopping: See a ₹1,180 price tag inclusive of 18% GST? Base is ₹1,000, tax is ₹180.

Why Learning GST Calculation Matters

In the business game these days, GST know-how isn’t just for accountants. Small vendors, freelancers, and online sellers all win by getting it. Even as a buyer, it helps you verify bills and skip overcharges.

Mastering both methods lets you handle invoices like a pro, check receipts without stress, and play by the rules easily.

Frequently Asked Questions on How to Calculate GST

Final Words

Getting the hang of GST calculations isn’t just about following the law—it’s a smart money skill for everyday deals. Whether you’re adding exclusive GST, breaking down inclusive prices, doing reverse calculations, or figuring out penalties like interest and late fees, it all clicks once you know the basics.

By trying it out with real examples and leaning on a good GST calculator, businesses and shoppers alike can keep things accurate and clear in every transaction.